- HOME

- Payroll administration

- Full and final settlement: rules, components, and format

Full and final settlement: rules, components, and format

Letting an employee go is difficult for any business owner. It directly impacts daily operations and the company's work culture. But once you make the decision, you must ensure a thorough exit process. In India, labour laws govern the termination and exit process of employees. Having a smooth full and final settlement process keeps you legally compliant and reflects the respect you have for your employees.

Exit formalities vary from company to company. Generally, the process includes an exit interview, clearances from different departments, the full and final settlement (FnF), and the release of a relieving letter.

- Exit interviews help you identify the problems within your company and reduce attrition rates.

- Getting clearances from the IT, admin, and HR teams before letting your employee go prevents any issues between you and the employee in the future.

- Full and final settlement is one of the most crucial aspects of the process. The employer must pay the employee until their last day of work. The FnF amount can include incentives, gratuity, pension funds, and leave encashment.

- Once the final amount is processed, the relieving letter is sent to the employee's personal email.

With changing laws, it will be challenging to streamline the offboarding process—especially the final settlement step. We've written this article to walk you through the components of an full and final settlement, including how to calculate the amount, when to pay the settlement, and how to format the final settlement letter.

FnF full form and meaning

The full form of FnF is Full and Final Settlement. It refers to the process of clearing all dues owed to the departing employee.

The final amount includes salary up to the last working day, encashment of unused leaves, gratuity, pension, and other incentives. Whether the employee resigns, retires, or is terminated, the FnF amount must be paid within a specific time to ensure all financial obligations are settled.

When do you pay an FnF?

The last day to settle the final pay check varies from one country to another. Companies in India take anywhere from 45 to 60 days after the employee's last working day to process the final settlement. A few organisations even take up to 90 days to pay the FnF amount. However, the newly passed code on wages mandates companies to settle final dues within two days of an employee's last working day.

The new code is awaiting approval from the state governments. Once the code is implemented nationwide, companies will have to reorganise their payroll schedule and ensure they settle FnF amounts within two working days.

Clearances required to process the FnF

The following clearances are required to process the final and full settlement:

| Department | Required clearance |

| IT |

|

| Admin |

|

| HR |

|

Components of an FnF

Unpaid salary

As per the Payment of Wages Act, companies with less than 1000 employees should pay wages before the 7th day after the last day of a wage period. In companies with more than 1000 employees, wages should be paid before the 10th day. However, in the case of employee resignation, termination, or retirement, companies must calculate their salary until their exit date and pay that amount along with the final settlement.

Leave encashment

Leave encashment is the amount received by an employee in exchange for any unused paid leaves provided by the organization. Calculation of leave encashment varies from one company to another because of different leave policies. During the employee's exit from the company, the encashed amount is settled along with the final pay.

Read our detailed article on computation and taxation of leave encashment here.

Bonus and incentives

Many organisations offer bonuses and other incentives based on employee performance and the company's revenue. In the case of a departing employee, employers will award the bonus amount to the employee along with the FnF settlement.

Gratuity

Gratuity is a one-time monetary benefit paid to long-serving employees. According to the Payment of Gratuity Act, 1972, employees who have completed five years of continuous service with one employer are eligible for gratuity pay.

Try Zoho Payroll's free gratuity calculator tool and compute gratuity pay now.

When an employee who is eligible for gratuity leaves your organisation, you have 30 days to pay the gratuity amount to them. If there is any delay in the payment, you will need to pay the interest along with the sum to your employee.

Read more about gratuity rules here.

Employees' Provident Fund

The employees' provident fund (EPF) is a retirement benefit scheme maintained by the Employee's Provident Fund Organisation (EPFO), the social security body of India. Under this scheme, all companies with more than 20 employees should register for EPF voluntarily. Both the employer and employee must contribute 12% of the employee's PF wage per month towards the retirement fund.

It is the employer's responsibility to let the departing employee know about the status of their PF account while settling final dues. At the time of retirement, the fund is payable to the employee. If the employee resigns to take a new job, the PF account will be transferred to the new company. The employer must update the employee's exit date on the EPFO portal.

Read more about the EPF scheme here.

Deductions

Employers can deduct professional tax, income tax, and monetary compensation for any portion of the notice period the employee does not serve from the FnF amount. Employers can also deduct the appropriate amount from the final settlement if the employee has any outstanding loan from the company.

Business owners or payroll professionals must calculate and deduct tax from the final settlement amount. Tax on gratuity and encashed leave is fully or partially exempt based on the computation provided by the labour law. The remaining FnF amount is taxable according to the income tax slab the employee falls under.

Once the payroll department makes the relevant deductions, the FnF amount is credited to the employee.

Final settlement letter

An FnF letter notifies the departing employee that they have received all dues from the company, and that they do not have any grievances against the employer. This letter officially validates the employee's exit from your company.

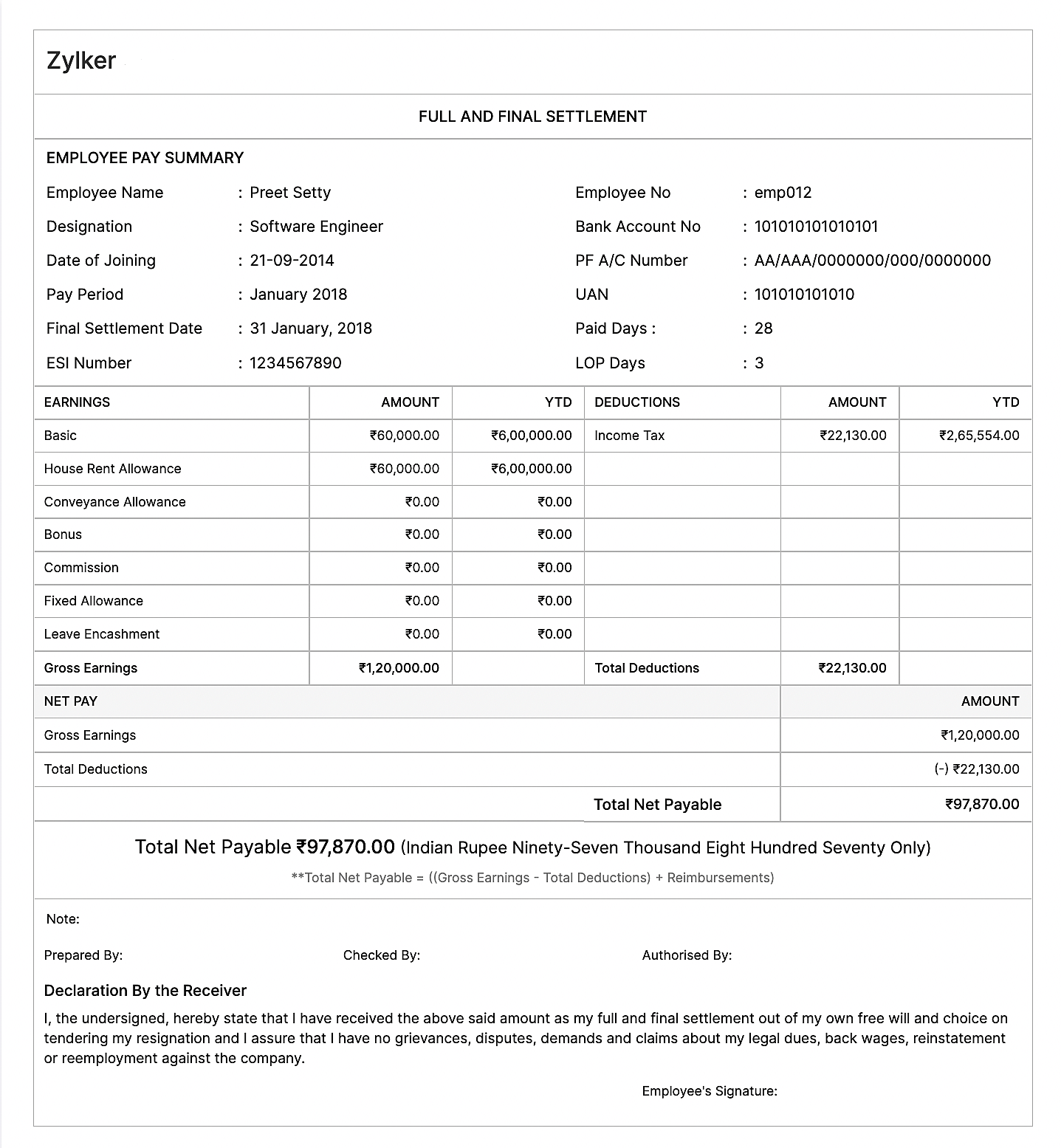

The format of the FnF letter varies from organisation to organisation. The letter can be well-detailed and can list out all the components for which the employee is getting paid. A final settlement payslip should have the following information:

- Employee name and ID number

- Date of joining

- Final settlement date

- UAN number

- Final settlement amount

- Tax deducted

- Declaration by the employee

Full and final settlement sample

Note: Form 16 is a certificate issued by the employer that contains information related to the employee's salary and income tax deductions made at source. The employer should send this form to the employee's personal email when sending the final payslip.

To sum up

Full and final settlement is the process of paying all of the balances due to a departing employee. It includes the employee's unpaid salary, leave encashment amount, bonuses, gratuity, provident fund contributions, and deductions. The payroll team should get clearances from the HR, admin, and IT teams before processing the FnF amount.

Settling final dues can be a tedious exercise when done manually, but payroll software can streamline the process and ensure timely FnF payouts.

Zoho Payroll, a cloud-based payroll software, helps automate calculations and makes the offboarding process easy. Once you enter your employee's last working day, reason for exit, and the final settlement date, the software will run the termination payroll for you.

Zoho Payroll allows you to configure gratuity, loss of pay, and notice pay systematically. The software helps you to generate and send Form 16 along with a customizable final settlement payslip to the employee's email.

Take Zoho Payroll for a spin today and effortlessly manage all payroll-related activities!