- HOME

- Payroll administration

- Conveyance allowance meaning, exemption, and tax rules

Conveyance allowance meaning, exemption, and tax rules

Most Indian organisations provide various allowances to employees in addition to their fixed basic salary. These allowances help cover expenses and allow them to claim certain tax benefits.

Conveyance allowance is one of the most common types of allowances offered. This article will help you understand the meaning of conveyance allowance, its purpose, calculation rules, and tax exemption limits.

Conveyance allowance meaning

Employers give conveyance allowance to employees to cover travel expenses that employees incur while performing office duties within the city. Its purpose is to refund expenses for fuel, public transportation fares and other travel-related costs. This allowance can be a fixed amount or a percentage of the employee's basic salary.

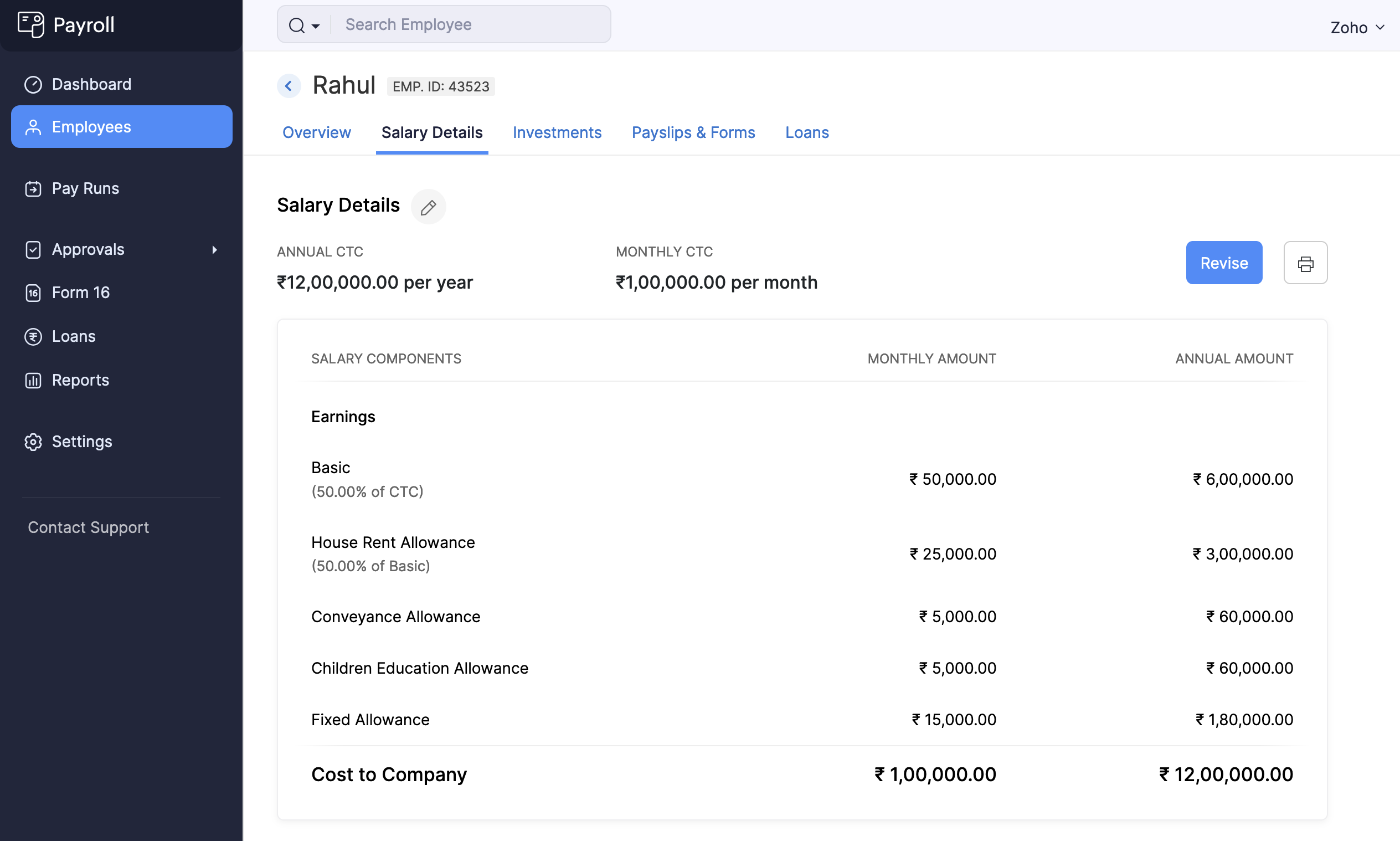

Here is a salary structure of an employee where you can see their conveyance allowance.

Calculation of conveyance allowance

Conveyance allowance for private sector employees is typically calculated as a fixed, flat amount. This amount is agreed upon between the employer and the employee at the time of hiring and is usually mentioned in the job offer letter. There is no legal limit on how much can be offered as conveyance allowance, but it is generally lower than the house rent allowance.

For central government employees, the conveyance allowance is determined by the government based on the distance travelled and the purpose of travel.

| Average travel distance covered when on office duty | Allowances when travelling by own car | Allowances when travelling by other modes of transport |

| 201 - 300 kms | ₹1,680 | ₹556 |

| 301 - 450 kms | ₹2,520 | ₹720 |

| 451 - 600 kms | ₹2,980 | ₹960 |

| 601 - 800 kms | ₹3,646 | ₹1,126 |

| More than 800 kms | ₹4,500 | ₹1,276 |

Source: https://doe.gov.in/files/cenetral-pay_document/Convey_Allow_Eng.pdf

Is conveyance allowance taxable?

Yes, conveyance allowance in salary is taxable regardless of the tax regime. However, an exemption is available for the actual expenses incurred for official purposes.

Note: Conveyance allowance offered to UPSC members or chairman is not taxable as per Section 10(45) of the Income Tax Act.

Conveyance allowance exemption for AY 2024-25

For the current assessment year, salaried individuals can claim a tax exemption on the amount received as conveyance allowance to the extent of actual expenses incurred.

For example, if an employee receives ₹50,000 per year as a conveyance allowance but has only spent ₹30,000 on commuting while performing official duties, their taxable conveyance allowance will be:

- Annual conveyance allowance = ₹50,000

- Exemption limit (Actual expenses incurred) = ₹30,000

- Amount exceeding the exemption = ₹20,000

The remaining conveyance allowance of ₹20,000 will be added to the employee’s taxable income and taxed according to their applicable income tax slab.

Conveyance allowance rules

Here are some key aspects of conveyance allowance that you should know:

- Amount: The amount of conveyance allowance may vary between companies, but the exemption limit is standardised across all employers.

- Provision of transport services: Companies that do not offer conveyance allowance typically provide transportation services to employees.

- Taxability: Conveyance allowance is exempt from tax only for salaried individuals. Self-employed individuals are not eligible for this exemption

- Tax exemption: The exemption for conveyance allowance is limited to the actual expenses incurred by the employee and is governed by Section 10(14)(ii) of the Income Tax Act, 1961.

Difference between conveyance allowance and transport allowance

A conveyance allowance is provided to cover costs incurred while performing official duties, such as travel within the city for work. It is exempt from tax only to the extent of the actual expenses incurred.

Transport allowance helps cover commuting costs between home and office or personal expenses for employees working in the transport sector. It is fully taxable for all employees in both tax regimes. However, for physically challenged employees, the tax exemption limit is ₹3,200 per month under both tax regimes.

The bottom line

Understanding conveyance allowance is crucial for managing employee benefits effectively. Conveyance allowance helps cover commuting costs for official duties and provides tax advantages up to a specified limit.

For seamless management of allowances and other salary components, consider using Zoho Payroll. The cloud-based payroll software simplifies the process of managing employee allowances, ensuring compliance with tax regulations, and providing accurate and timely payroll processing.

Frequently asked questions

Is conveyance allowance included in the ESI calculation?

No, conveyance allowance is not part of the Employees State Insurance (ESI) calculations. As per a Supreme Court ruling in March 2021, conveyance allowance is not classified as a wage under the ESI Act of 1948. Therefore, it is not included when calculating ESI contributions.

Can an employee avail conveyance allowance if they are working from home?

When an employee does not travel around for office purposes, they usually will not receive a conveyance allowance.

Can employees get a conveyance allowance if they do not use company transportation?

Typically, companies that provide transportation services do not offer conveyance allowance, even if the employees choose not to avail the service.