- HOME

- Expense Management

- A complete guide to business expense tax deductions to maximize write-offs for US businesses

A complete guide to business expense tax deductions to maximize write-offs for US businesses

What are business expense tax deductions?

Every business, big or small, incurs expenses to build and run their operations. These expenses are completely or partially eligible for tax deductions based on the rules set by local regulatory authorities. In the US, the Internal Revenue Service (IRS) is the regulatory authority tasked with determining these business expense deductions.

Business expenses such as depreciation costs, insurance premiums, mileage and vehicle maintenance expenses, employee bonuses, travel expenses, and the like each have specific rules for tax deductions. The IRS publishes literature on how to calculate the deductible amount for your business's expenses based on the expense categories and the type of your business. To promote commerce and small business developments, the IRS also specifies tax rules and guidelines for small business tax deductions.

While businesses calculate their taxes, errors such as double counting expenses, incorrectly categorizing expenses, or counting personal expenses as business expenses can create trouble for companies, leading to IRS audits and penalties. This makes it absolutely critical for companies to categorize their business expenses and calculate deductible amounts correctly.

What qualifies as a deductible business expense?

IRS deductible expenses are defined as follows:

"To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your field of business. A necessary expense is one that is helpful and appropriate for your business. An expense does not have to be indispensable to be considered necessary."

While most business expenses can be easily tracked, such as inventory expenses or salaries towards sales personnel, some others, such as fuel bought for a personal car that is used for business purposes as well, fall in a gray area. Differentiating business expenses from personal expenses in such scenarios is necessary for calculating tax deductions. The IRS specifically mentions such use cases and directs businesses to separate the cost incurred toward business expenses from the above example and only state that in the tax write-off for your business.

Key business expense categories and tax rules

Operating expenses

Operating expenses such as office supplies, utilities, rent, and maintenance costs fall under the necessary expenses definition and are deductible for taxes.

Utilities include heat, light, power, phone, Wi-Fi, water, and sewerage expenses incurred by the business and are dynamic as per the overall usage for the billing cycle. All of these expenses are a part of the deductible expenses incurred by the business as per IRS rules.

Rent is defined by the IRS as "any amount you pay for the use of property you do not own." The IRS also clarifies that rent is deductible only if the property or the rented space is used for business purposes. If the business owns equity in the property, then rent is not deductible.

Another aspect to consider is the issue of "Unreasonable rent," which comes into effect if the rent is paid by the company to related persons of the business owner and is over and above the going rate of the market. If the rent is unreasonable, it cannot be written-off by the business for tax deductions.

Employee and payroll costs

The IRS allows businesses to deduct the amount compensated to employees, which can be paid via cash, service, or property. The pay includes:

- Wages

- Salaries

- Bonuses

- Commissions

- Other non-cash compensation, such as vacation and fringe benefits

As with all the other business expense categories, employee and payroll costs can also be tested on their "reasonableness" and "the ability to prove the service was performed" to be considered deductible.

Marketing and advertising deductions

Included under "Miscellaneous expenses" in the IRS's guide to business expenses, marketing and advertising expenses follow the same rule of "reasonableness" when writing off taxes. Expenses across digital advertisements, social media marketing, branding, website management, and event sponsorships are thus covered under deductible marketing and advertising expenses as long as they promote the product or service provided by the company and the amount paid is "reasonable" or equal to market prices.

Another specified expense that businesses can deduct and loosely falls under advertising expenses would be promoting donations towards humanitarian organizations, government's public service schemes, and more. The IRS specifies "Lobbying expenses" as nondeductible and identifies these as expenses incurred to influence legislation, political campaign interventions, influencing the public towards referendums, legislations, or elections, or any activity directly related to these expenses.

Travel, transportation, and meal deductions

Businesses incur substantial amounts of money in terms of transportation, travel, accommodation, and meals.

According to the IRS, transportation benefits include transportation via commuter highway vehicles, transit passes, or even parking fees when employees travel between their residence and their place of employment. These benefits are nondeductible.

Any entertainment expenses incurred by the business have clear rules from the IRS; they are strictly nondeductible.

On the other hand, business travel expenses refer to the expenses incurred when employees travel away from their tax home, meaning the general area where the main place of business is located. Some of the expenses included in this category are:

- Flight, bus, train, car, or cabs

- Lodging

- Meals

- Mileage

- Dry cleaning or laundry

- Tips

- Phone bills

- Per diem allowances

- Miscellaneous

Meal expenses fall under the 50% deduction rule, which specifies that for any business meal, which includes meal expenses incurred by employees travelling or for meals with clients or stakeholders, businesses can only deduct 50% of the cost. Meals provided by businesses to their employees and a few other temporary exceptions allow a 100% deduction in the business meal category.

Per diem allowances, on the other hand, are allowances meant to cover the employee's lodging, meals, and incidental expenses when traveling for business. These are published by the General Services Administration (GSA) and adopted by government agencies. As for non-governmental organizations, these published rates act as the taxable limits for deductions. While companies may set per diem allowances as they deem fit, these allowances are tax-free only up to the amount specified by the GSA. Check out this GSA Per Diem Calculator to see the deductible GSA per diem rates as per your travel destinations.

Mileage expenses incurred by the business, similar to the per diem rates published by the GSA, are published by the IRS for taxation purposes. Mileage and vehicle expenses incurred by employees and business vehicles are deductible only up to the rates as published by the IRS, and as with any other expense, there are a few exceptions.

The rest of the expenses do not have any restrictions and are deductible based on the reasonableness of the expense.

Professional services and fees

All professional services and fees directly related to business operations are deductible in nature. Some examples of professional fees incurred for business purposes include accounting, tax, consulting, engineering, architectural, designing, public relations, market research, and the like.

Capital expenditures and depreciation

Capital expenses are incurred by businesses to acquire machinery, equipment, or property. The IRS allows businesses to capitalize, depreciate, and amortize capital expenses over time. Capitalization can be done for three types of costs: business start-up costs, business assets, and improvements. For repairs, the IRS states that the cost is deductible in the year in which the repair takes place.

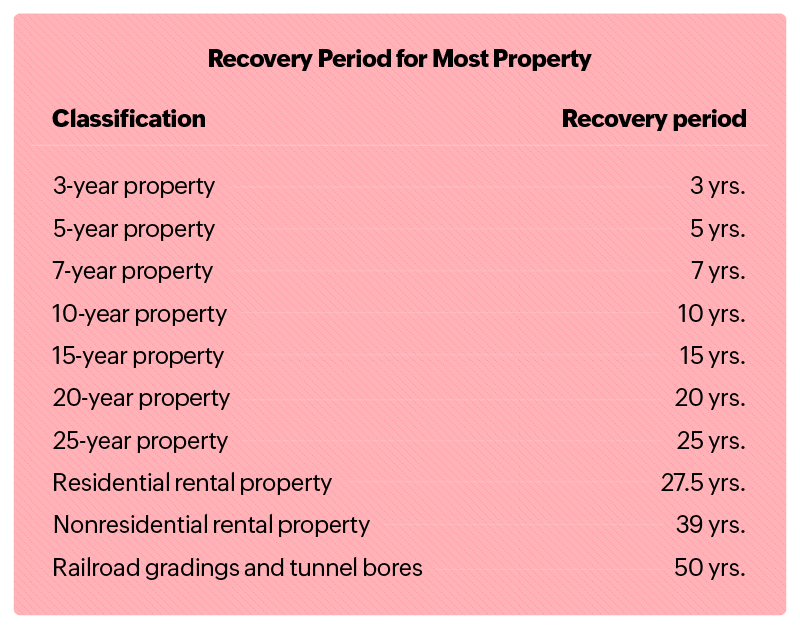

Depreciation can be calculated using multiple methods:

- Modified Accelerated Cost Recovery System (MACRS)

- Straight line depreciation

- Section 179 property deduction

The depreciation percentage that can be deducted in the MACRS depends on the recovery period of the asset, which has been explained in the below diagram.

Section 179 property deduction lists exceptional assets and the maximum deduction limit for these assets in the tax years beginning in 2024 as $1,220,000.

Insurance costs and business protection

Premiums paid for insurance related to your business, trade, or profession are generally deductible. However, the IRS has deemed premiums nondeductible for self-insurance reserve funds, loss of earnings, insurance taken to secure a loan, or certain specified life insurance and annuities.

You can generally deduct premiums in the tax year in which they apply. Although, you can choose to account for the premiums paid using the cash method, accrual method, or via prepayment. Prepaid premiums can be deducted only in the year in which they apply, and not in advance.

Employee training and education

Ordinary and necessary expenses incurred for the training and education of your employees are also deductible. Upskilling employees is a trend that many companies are now undertaking. Specially with the advent of technological advancements such as artificial intelligence, virtual reality modeling, and others, training activities are being increasingly taken up by many companies. Categorizing these business expenses as employee training and education allows your business to save taxes on the same.

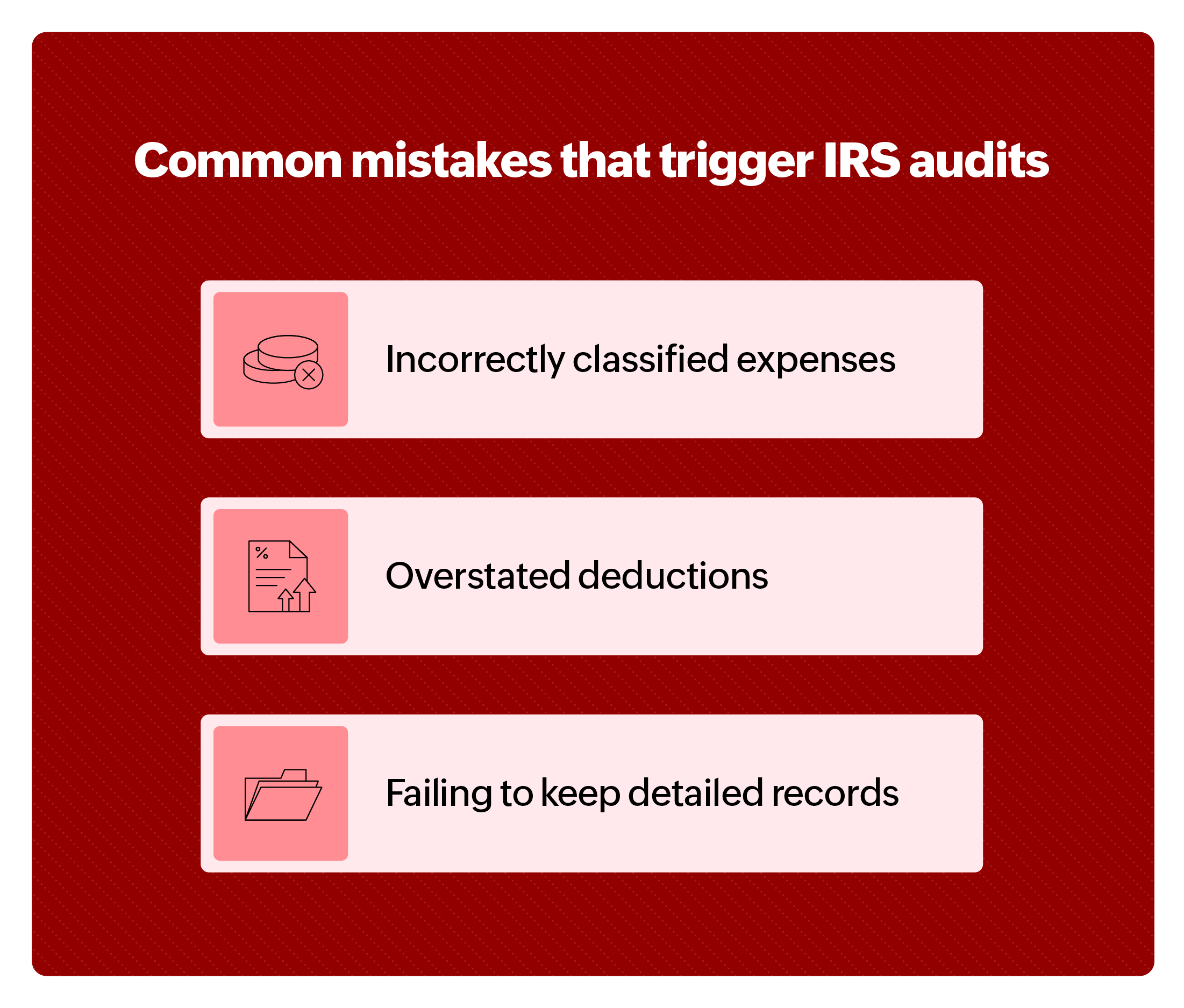

Common mistakes that trigger IRS audits

Some of the more common tax filing errors that new and small businesses filing taxes make are listed below.

Incorrectly classified expenses

Given that every expense category to be deducted has a space on the IRS tax form, it is absolutely crucial that businesses correctly classify their expenses. In situations where an expense falls under multiple categories, businesses can ensure that the deductions are either split as per the correct category or filed under only one of the two categories and not duplicated.

For example, if the organization spends on providing a creche facility for their employees' children, then, the cost cannot be deducted by the company as employee benefits. It will instead be split across expense categories such as utilities, salaries, rent, and the like, as the case may be.

Overstated deductions

Another possible error that organizations must be wary of is overstating the amount to be deducted. Companies must ensure every supporting document for the stated deduction is maintained and produced when requested. Excessive travel costs or disproportionate per diem allowances as compared to the business's revenue are highly likely to trigger IRS audits.

Failing to keep detailed records

The IRS allows businesses to store most records, including receipts, deposit slips, forms, financial statements, bank statements, contracts, agreements, licenses, and more, digitally. Now that most official documents accept digital signatures, the need for storing physical documents has reduced, easing the process of record keeping. Missing requested records or failing to attach them during filing may lead to the IRS knocking on your door for a thorough audit.

Tips and tools to maximize tax deductions

Taking into consideration all of the above requirements and IRS rules, here are a few tax preparation tips and tools that can help improve your business tax planning.

How can you leverage apps for tracking business expenses?

Switching to business applications that can capture, store, process, and sync business expenses with the company's financial platform helps businesses ease the expense management process drastically. Some of the best expense tracking apps and platforms, like Zoho Expense, offer employees the ease of capturing expenses and submitting them for approvals on the go. With the digital copy autoscanned and automatically categorized, accountants can easily differentiate the total expenses for every category allowing them to simplify their tax filing process. Apart from receipt scanning, Zoho Expense is also equipped to automate expense categorization, submission, sync, and reporting right into your accounting platform to ensure no expense is missed and every deduction is accounted for, ultimately maximizing your tax deductions.

When should you consult a tax professional?

For businesses that incur expenses across multiple channels and in large amounts, it is imperative that tax filings are scrutinized and no margin of error remains. Enterprises often deal across multiple geographies and have revenues in multiple currencies that follow complicated tax rules. These situations demand businesses to consult and leverage the extensive knowledge tax professionals possess to ensure every detail filled in while filing taxes is up to the mark.

Stay tax smart and save more

Elevate your business expense planning and strategies with the following key takeaways that will help you prepare for next tax season:

- The IRS is responsible for establishing and enforcing tax rules for businesses in the US.

- To be deductible, all business expenses must be ordinary and necessary.

- Most key business expenses must be "reasonable," which means they need to be equal to or near to the market's going rate.

- Per diem rates are published by the GSA, and reimbursement rates are published by the IRS that act as tax deduction limits.

- Depreciation amounts to be written off depend on the recovery period of the asset and is mostly calculated using the MACR system.

- Common mistakes to keep in check that may trigger IRS audits include incorrectly classifying expenses, overstating deductions, failing to keep detailed records, and similar errors.

- Maximize deductions and write-offs by digitizing the expense management process through applications like Zoho Expense for automating expense tracking, ensuring digital record-keeping, and leveraging the help of tax professionals when necessary.

Ready to streamline your business expense management for better tax preparation? Try Zoho Expense's 14-day free trial today.

Frequently asked questions

How do I determine if an expense is "ordinary and necessary" for my business?

An ordinary expense is one that is common and accepted in your industry. For example, research and development companies working with nuclear material may deduct expenses towards the procurement of nuclear materials that would be considered ordinary. On the contrary, a textile manufacturer who does not need nuclear materials for their business purposes cannot deduct a similar expense.

A necessary expense is one that is helpful and appropriate for your business. For example, office stationary, equipment, and furniture would be a necessary expense for most businesses in order to facilitate their day-to-day operations. Such expenses, would thus, be deductible as per the IRS.

Can I deduct business expenses for my home office?

The IRS rules that only expenses incurred purely towards business and trade purposes, which includes expenses incurred to set up your primary place of business, will be considered for deductions. Although, if you operate out of a home office, it can also be qualified as your principal place of business if it satisfies the following criteria:

- You use that place exclusively for your business activities.

- You have no other location where you conduct the majority of any of your business activities.

- Dhwani

Dhwani Parekh is a seasoned FinTech content writer with more than 7 years of experience in SaaS marketing. As a contributing expert at Academy by Zoho Expense, she focuses on uncovering trends that empower businesses to streamline their financial operations, especially business travel and expense management. With deep industry knowledge and a pulse on the rapidly evolving landscape of business spend, Dhwani’s content adds tremendous value to Academy by Zoho Expense.