- HOME

- Expense Management

- 10 essential business expense categories every finance professional must know

10 essential business expense categories every finance professional must know

What is said to be the first step to building a business? An idea. The ability to identify a gap, a need, or an opportunity. Entrepreneurs throughout history have been defined by their abilities to do just so. While most of the successful business leaders are absolute geniuses in getting to know their customers and fulfilling their demands, comprehending the financial part of the business is a challenge that many struggle with.

Here's breaking it down in the simplest terms: Businesses run for profit, and profit is what's left after expenses are removed from earnings. Earnings are what most entrepreneurs focus on because, well, that's what their business is working towards. But expenses, these numbers always come with "room for potential savings." No matter how frugal your expense policies are or how good a deal you crack with your suppliers, businesses always seem to have room for improvement when it comes to business expenditure.

The first order of business when understanding this potential is to understand where the money goes. Being able to categorize expenses and zero in on the channels where the money flows out of your business helps you get visibility into your expenses. This visibility further helps you identify and track the decisions that affect these expense numbers, helping you build ever-improving strategies to ensure continuous savings. Moreover, government regulations regarding tax savings and other monetary benefits are also tied to expense categories, making it imperative that every financial professional understand business expense categories to the fullest.

Overview of the 10 essential business expense categories and tips to save on these expenses

Operational expenses

Operational expenses refer to the expenses that are incurred to keep the business running smoothly. These include rent, utilities, office supplies, maintenance, janitorial services, and more. These business expenses are absolute necessities and are essential in the day-to-day operations of your business.

Expense savings tip: The best way to look for opportunities to save here is through contractual savings. Whether it is your annual janitorial or security service contract, rental agreement, or minimum purchase order for office supplies, negotiate with vendors to get the best prices and build vendor relations to ensure quality and seamless delivery.

Inventory expenses and cost of goods sold (COGS)

For manufacturing businesses, inventory is a cost that directly adds to revenue, often aiding companies in building their pricing strategies. This expense, thus, is a default expense that is incurred even if you're a solopreneur selling resin art out of your home. From raw materials to packaging, every penny spent creating your offering goes towards this expense.

Expense savings tip: Leverage economies of scale but balance them with your demand forecasts to ensure you do not have "dead inventory."

Payroll and employee expenses

Companies with employees to care for as they build their businesses incur substantial payroll and employee benefit costs such as health insurance, pension plans, bonuses, housing, and more. Depending on the nature of the business, you may incur higher costs to attract and retain talent that helps businesses earn higher ROIs and stay ahead of their competition.

Expense savings tip: Flexible benefit plans that help employees choose their benefits not only help employees maximize their tax savings but also help organizations save on expenses that employees opt out of.

Marketing and advertising expenses

No business can survive without marketing. Whether it is word-of-mouth carried by your well-wishers or a Times Square Jumbotron ad placement, every marketing dollar spent is a business expense that adds to the bottom line. While most startups leverage organic promotional opportunities at the start, as they grow, they need to go beyond their saturated local market to sustain themselves, ultimately increasing marketing and advertising expenses.

Expense savings tip: Leverage SEO and content marketing across social channels to grow your digital presence organically. Open-source AI chatbots are quite helpful in building content strategies and generating content for the same.

Travel and transportation expenses

Business travel bookings, mileage expenses, per diem expenses, meals, and incidentals are some of the expenses that companies bear when their employees travel for work. Employees are often travelling for customer meetings, events, prospect visits, or onsite visits to improve customer relations.

Expense savings tip: Corporate travel platforms and agencies help companies save on major travel booking costs for flights, hotels, and cabs while also allowing employees to choose and book within set policies. Investing in such solutions helps save more in the longer run.

Professional services and outsourcing

Every organization needs to hire professional services for many supporting departments such as maintenance, security, cleaning, or logistics. For project-based or one-time services, companies often choose to outsource the work to agencies and freelancers, allowing flexibility and timely delivery of services.

Expense saving tip: Since these services are often on a contractual and short-term basis, negotiation options are low. Although most of these services are businesses looking for word-of-mouth promotions, referrals, and testimonials to help build credibility, they offer discounts, freebies, and more to promote the same. Leverage these loyalty bonuses to get better recurring deals.

Insurance expenses

Businesses need to invest in numerous insurances to protect themselves and in some cases to comply with regulatory requirements. Some of the insurance expenses include general liability insurance, fire insurance, worker's compensation insurance, employee health insurance, and more.

Expense savings tip: Many insurance companies in the market often offer bundles and packages based on the nature of the business, size of the business, and more to help businesses ease the application process as well as help save on premiums.

Technology and software expenses

Technology and software are some of the most important expenses these days. IT teams are the backbone of most companies as they work on streamlining business processes, safeguarding data, and ensuring employees work without any technical interruptions and glitches.

Expense savings tip: With a variety of solution providers and technology in the market, ensure you match your requirement to the solution's capabilities before you invest in the same. From implementation to change management and ultimately adoption, companies can negotiate prices across all stages in return for promised growth percentages and referrals.

Taxes and fees

Government taxes, licenses, legal fees, and other regulatory expenses that are necessary to set your business up and keep it running will fall under these expenses. Taxes and fees are necessary expenses for every business and cannot be avoided. Ensuring timely and correct payments allows businesses to avoid late fees and surcharges.

Miscellaneous

All other expenses companies must incur based on the nature of their businesses, which do not come under the above expenses, are often included here. These expenses are often a small percentage of a company's business expenses.

Expense savings tip: Identify recurring expenses in this category and re-categorize them to ensure better visibility and control for the same.

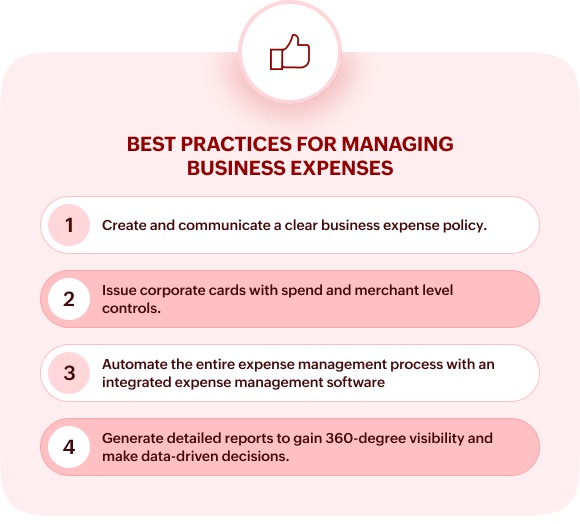

Best practices for managing business expenses

- Expense policy: A business expense policy with custom limits on each business expense category, communicated to the respective departments handling these expenses, will help businesses keep the spend within budget and apply controls before the spend occurs.

- Cards: Corporate cards, P cards, T&E cards, vendor cards, virtual cards, and more are some of the options available in the market for specific spend management. These cards are often built-in with spend control options to ensure users do not overspend. These category-specific cards are an easy solution for absolute visibility and control.

- Expense management software: An expense management software that can handle all card expenses, employee expenses, and purchase expenses incurred by the company will help ease, optimize, and analyze expense management processes for better results.

- Analytic reports: Reports that showcase expenses at individual category levels and overall expenses at strategic levels help businesses keep tabs on how budgets are being utilized and what changes need to be done to ensure savings objectives are fulfilled.

- Audits and compliance: Automate audits and compliance policies across all expenses incurred across the business. Specifically, petty cash expenses and employee expenses that happen at individual levels are often overlooked, making them vulnerable to overspending. Automating audits at the time of expense submissions ensures employees are aware of the policy requirements and control expenses based on the same.

Conclusion

Wrapping up, business expense categories play a crucial role as they help businesses not only streamline their expense management process but also help save money. Identify expense categories that are relevant to your business and set up automation processes for approvals, analytics, policy enforcement, and audits to ensure your business expenses always stay within budget. Check out cloud software platforms such as Zoho Expense that can help automate these processes while allowing businesses to scale and implement faster with varying pricing plans and an easy-to-use interface.

Frequently asked questions

What are business expense categories, and why are they important?

Business expense categories refer to the logical groupings of all expenses incurred by businesses for their operation. Expense categories help businesses track their spending, identify leaks, correct errors, file taxes, comply with government regulations, and help build budgets and forecast strategies for better finance management.

What is the difference between a business expense and a personal expense?

Business expenses are expenses incurred specifically to aid business operations, ensure business continuity, or generate revenue. A personal expense, on the other hand, is a purchase for personal use and does not have any direct relation to business activities. In situations where expenses are incurred for personal and business reasons together, one must calculate the portion of the expense that was incurred specifically for business use to be added to your business expenses.

What is the difference between direct and indirect expenses?

While direct expenses are costs incurred towards the production or creation of a specific product or service, indirect expenses are incurred as supporting expenses to ensure revenue and continuity. Cost of goods sold, raw materials, and machinery are some examples of direct expenses. Sales salaries, marketing and advertising, and administrative expenses are some examples of indirect expenses.

What is the difference between fixed and variable expenses?

Fixed expenses, as the name suggests, are fixed amount expenditures that are incurred by businesses, often recurring in nature. Rent, insurance premiums, loan payments, and the like are some examples of fixed expenses.

Variable expenses, on the other hand, fluctuate depending on different criteria such as manufacturing quantities, sales, usage, and more. Raw materials, logistics costs, utilities, and more are some examples of variable expenses.

Are all business expenses tax deductible?

No, not all business expenses are tax deductible. The IRS has specific rules about which expenses are deductible and which are not.

According to the IRS, to be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. Although, the IRS also has limitations and prohibitions on certain sets of business expenses that may be non-deductible or partially deductible. Check out our blog post "Guide to maximizing US business tax deductions" to learn more about tax deductible business expenses.

- Dhwani

Dhwani Parekh is a seasoned FinTech content writer with more than 7 years of experience in SaaS marketing. As a contributing expert at Academy by Zoho Expense, she focuses on uncovering trends that empower businesses to streamline their financial operations, especially business travel and expense management. With deep industry knowledge and a pulse on the rapidly evolving landscape of business spend, Dhwani’s content adds tremendous value to Academy by Zoho Expense.